Partnership Firms in India are administered by the Indian Partnership Act, 1932. According to Section 4 of the Indian Partnership Act:- "Partnership is the connection between people who have consented to share the benefits of a business carried on by all or any of them representing all".

1. Partner :

4. Registered Office:

5. Registering Authority:

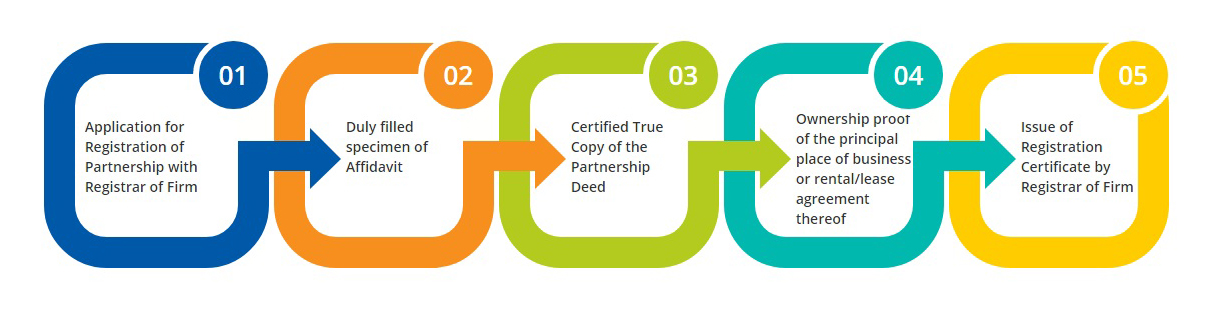

6. Required Documents:

Partners